Understanding the Importance of Reliable Insurance Plans

Why Modern Life Demands Strong Insurance Coverage

In today’s unpredictable world, having reliable insurance coverage has become a necessity rather than a luxury. Whether it’s life insurance, auto, health, or property, individuals need plans that cover both emergencies and routine expenses. According to https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html, choosing the best insurance policy depends on understanding your personal risks and financial goals. When you’re insured, you gain peace of mind, knowing you’re prepared for whatever life throws your way. The blog provides a user-focused guide on picking policies that are both economical and comprehensive, making it an ideal resource in 2025.

How https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html Helps Users

A Blog Post That Breaks Down Complex Information

The blog article is a trusted source for Spanish-speaking users who want clear, concise, and detailed information about insurance providers. It doesn’t just list companies; it explains features, highlights pros and cons, and gives actionable tips. https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html dives into the world of insurance without overwhelming the reader, offering insight into current market trends and the best insurance offers for 2024–2025. Its organized format and simple language make even complex insurance policies easy to understand.

Types of Insurance Covered in the Blog

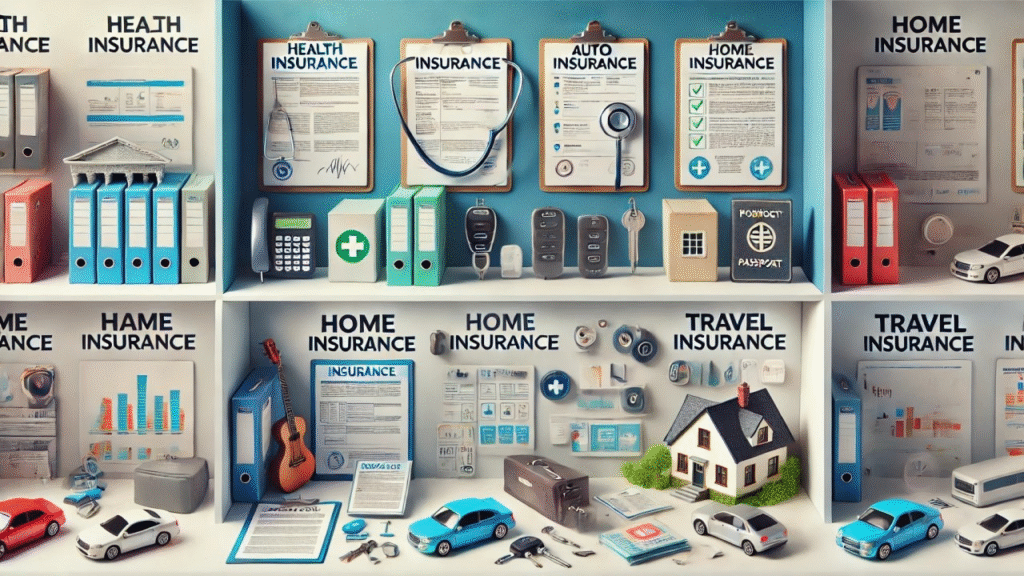

Life, Auto, Health, and Property Insurance Explained

The blog classifies insurance into key categories that readers are most likely to be interested in. Each category is explained with ample detail:

- Life Insurance: For those looking to protect their family’s future in case of sudden death or disability.

- Auto Insurance: Ideal for drivers who want legal compliance and protection against theft or accidents.

- Health Insurance: Essential for managing medical costs in both emergency and routine situations.

- Property Insurance: Covers damages caused by fire, natural disasters, or burglary.

These categories are explored with examples, pricing tips, and company recommendations that simplify the decision-making process for new and seasoned policyholders.

Benefits of Reading the Blog Before Buying Insurance

Knowledge is Power When It Comes to Choosing a Policy

Anyone who visits https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html before selecting a plan will notice a significant difference in their confidence and understanding. The blog offers side-by-side comparisons, risk analysis tools, and expert opinions that are otherwise hard to find. By reading through the well-researched content, users can avoid scams, overpriced premiums, and low-quality customer service. The post empowers individuals with the information they need to demand transparency and fairness from insurers.

Comparing Top Insurance Providers in the Blog

Key Players Analyzed for 2025 and Beyond

The article reviews various insurance companies and breaks down what each one offers. From global names like MAPFRE and Allianz to region-specific companies, every provider is assessed based on coverage, affordability, customer service, and claim processing. The blog even includes insider tips on how to negotiate your premium rates and what fine print to look for. If you’re unsure which provider to choose in 2025, the breakdown provided on https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html is a perfect starting point.

How to Choose the Best Insurance for Your Needs

Step-by-Step Advice from the Blog

Making the right decision requires you to evaluate several personal factors—income level, dependents, health status, property value, and risk exposure. The blog outlines an easy step-by-step strategy to find the best policy based on these factors. You’ll learn how to:

- Define your insurance priorities.

- Set a reasonable budget.

- Compare policies side-by-side.

- Ask the right questions before signing.

- Read policy documents thoroughly.

This method ensures you won’t be taken advantage of and will actually benefit from the policy in the long run.

Common Insurance Mistakes to Avoid

Insights Directly from https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html

One of the blog’s most valuable sections is about avoiding common pitfalls. It explains why people often overpay or underinsure themselves and how those mistakes can lead to financial disaster. For example, many people skip reading the exclusions or fail to disclose critical information, which later invalidates their claims. The blog gives real-life examples and simple advice that help readers avoid falling into such traps, saving both time and money.

What Makes a Good Insurance Policy in 2025

Key Features That Stand Out

Based on the evaluations from https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html, a good insurance policy in 2025 should have the following qualities:

- Comprehensive Coverage: Includes everything from accidents to chronic illness.

- Low Premiums with High Returns: Cost-effective plans with generous benefits.

- Fast Claims Processing: No delays or hidden procedures.

- Accessible Customer Service: Support that’s easy to reach and responsive.

- Transparent Terms: No hidden fees or complicated jargon.

These factors help define trustworthy insurance providers and keep users protected in real-world situations.

User Reviews and Real-Life Experiences from the Blog

Why People Trust https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html

The article includes reviews and testimonials from real users who have shared their insurance journeys. Whether it’s a health policy that saved a life or a car insurance claim that was settled quickly, these stories add credibility.

Readers gain comfort knowing others have walked the same path and successfully navigated their choices using the blog as a guide. It gives potential buyers peace of mind and validation before they commit to a policy.

How to Use the Blog for Your Own Advantage

Maximizing Your Insurance Knowledge in Minutes

Unlike traditional sources of information, https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html offers bite-sized, valuable insights that take minutes to digest but provide long-term financial wisdom. The site also keeps its information updated with changes in policies, pricing, and legal terms, making it a resource worth bookmarking. Whether you’re a college student, homeowner, or business professional, this blog can help you find the insurance solution that suits your unique lifestyle and goals.

Conclusion: Secure Your Future with Smart Insurance Choices

Choosing insurance doesn’t need to be confusing or overwhelming—especially when you have access to trusted, detailed, and easy-to-read content like https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html. This blog post acts as a one-stop destination for all things insurance-related in 2025. Whether you’re exploring your first policy or switching providers, using the information presented will save you time, money, and stress. The guide’s thorough explanations, expert analysis, and practical advice equip every reader with the knowledge to make smart, informed decisions. Take control of your future today—don’t wait for an emergency to realize the value of good insurance.

Top Takeaways from the Article

- Insurance is essential in today’s unpredictable world.

- The blog helps simplify complex insurance concepts.

- Users can compare top providers side-by-side.

- Real user reviews make the content trustworthy.

- Choosing the right policy ensures peace of mind.

FAQs About https://noticviralweb.blogspot.com/2024/05/mejores-seguros.html

1. What is the main focus of the blog post?

The blog focuses on reviewing and comparing the best insurance options for individuals in 2024 and 2025, offering expert recommendations and real-life insights.

2. Is the information suitable for first-time buyers?

Yes, the article is written in a beginner-friendly tone, with step-by-step guidance that helps first-time insurance buyers understand what to look for.

3. Does the blog post include company comparisons?

Absolutely. It provides a comprehensive breakdown of top insurance companies, helping readers choose the one that fits their specific needs.

4. Can I trust the reviews provided in the blog?

Yes, many of the reviews are from real users who have shared genuine experiences, adding credibility to the blog content.

5. Is the blog post regularly updated?

The blog aims to keep its content up to date with current market trends, policy changes, and user needs to ensure ongoing relevance.

Also Read This: Everything You Should Know About Vietc69